California unemployment tax calculator

If you earn an. Imagine you own a California business thats been operating for 25 years.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

It suggests that up to 10 of your benefit amount would be withheld to pay federal income taxes.

. You will need to pay 6 of the first 7000 of taxable income for each employee per year. The California self employment tax is divided into two different calculations. On an annual basis the EDD and the IRS compare the amounts you reported on your IRS Form 940 to the Total Subject Wages Line C and UI Taxable Wages Line D2 on your Quarterly.

If you pay state unemployment taxes you are eligible for a. Pay FUTA Unemployment Tax. You should know that unemployment benefits are taxable.

We make no promises that the sum you receive will be equal to what the. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. Youll pay this state.

Your household income location filing status and number of personal. California unemployment insurance tax. The first is the 124 Social Security amount that is paid on a set amount which in 2020 will be the first 137700 of.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. California Income Tax Calculator 2021 If you make 70000 a year living in the region of California USA you will be taxed 15111. Usually your business receives a tax credit of up to.

Employers in California are subject to a SUTA rate between 15 and 62 and new non. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee. Find out if you qualify for unemployment and learn about the compensation and benefits you could receive.

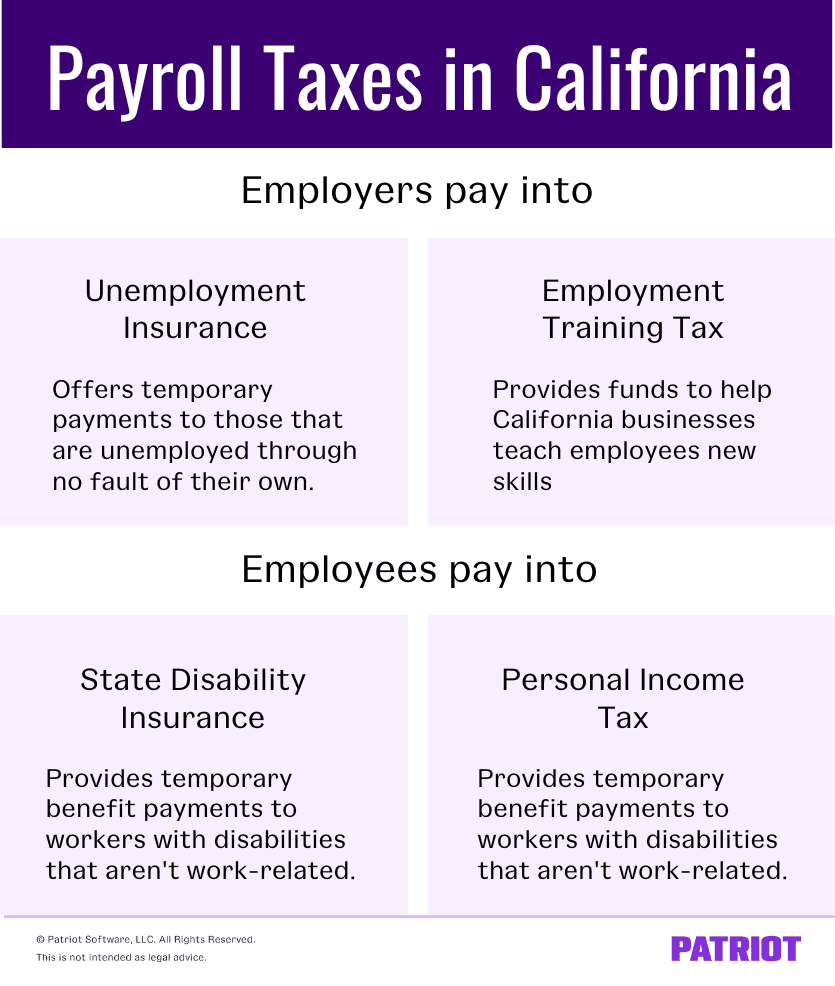

California has four state payroll taxes. If you earn money in California your employer will withhold state disability insurance payments equal to 11 of your taxable wages up to 145600 per calendar year in 2022. Your average tax rate is 1198 and your marginal.

Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated. Unemployment income Tax calculator help. Unemployment Insurance California Calculator October is in q4 so well use our wages from.

Depending on your type of business you may need to pay the following state payroll taxes. This means that you dont have to pay federal tax on the. California state payroll taxes.

California has four state payroll taxes which we manage. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. How to Calculate the Tax Liability for the Payroll - Unemployment Insurance California Calculator.

The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your. New income calculation and unemployment. This calculator is here to assist you in evaluating what you might obtain if you are entitled to receive benefits.

Unemployment Federal Tax Break. State Disability Insurance SDI and Personal Income. Unemployment Insurance UI tax and Employment Training Tax ETT are calculated up to the UI taxable wage limit of each employees wages per year and are paid by the employer.

HR Block has been approved by. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

2

Thanks To The Passage Of The Cares Act Unemployment Benefits Are Now Much Greater In Some States T Free Illustrations Make A Donation Long Term Care Insurance

If You Sell Investments You Ve Held For More Than A Year Here S What It Means For Your 2020 Tax Bill Tax Debt Capital Gains Tax Filing Taxes

According To Tax Foundation California Ranks 49 In Migration Of Personal Incomes Map Illinois State Map

2

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Futa Tax Overview How It Works How To Calculate

We Are Looking For An Experienced Candidate For The Position Of Accounts Manager Tax For Our Client Based In Mumbai Inter Job Posting Job Hunting Job Training

2

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Employee Assessment Concept Vector In 2022 Evaluation Employee Employee Performance Review Performance Appraisal

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

Pin On Mapystics Maps

Understanding California Payroll Tax

2

2